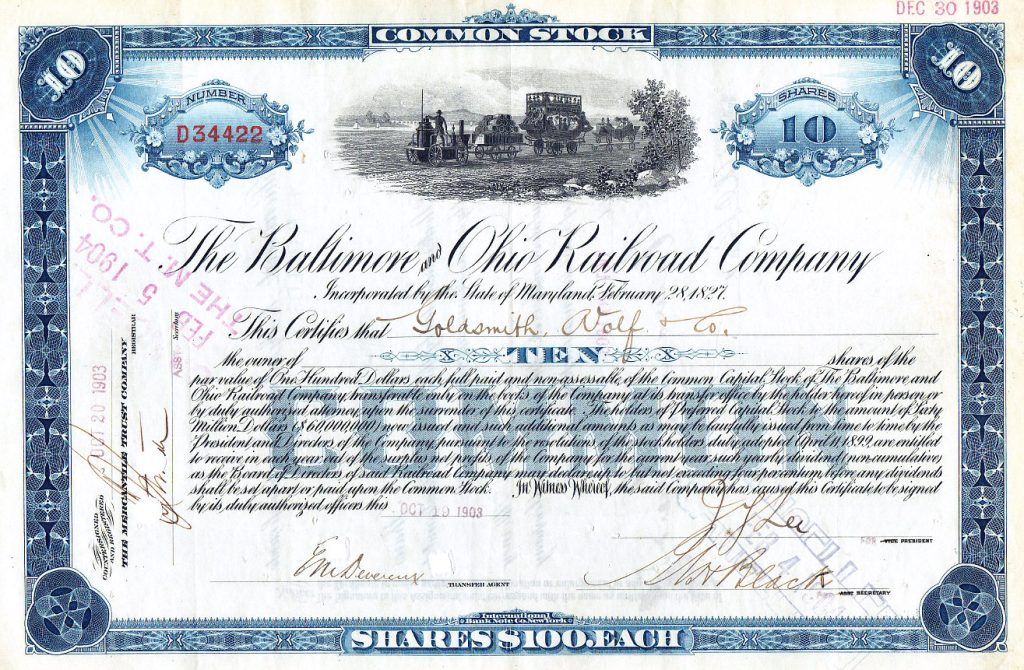

1. Stocks, Simply Put: A Piece of a Company

Think of a company as a pizza . If you cut it into eight slices, owning one slice means you own one-eighth of the pizza. Similarly, when you buy a stock, you own a piece of the company.

2. Why Do Companies Sell Stocks?

Companies sell stocks because they need money.

- Building factories, launching products, or expanding globally requires large amounts of capital.

- Instead of borrowing from banks and paying interest, companies can raise money by selling shares. Investors become part-owners in return.

3. How Do You Make Money from Stocks?

There are two main ways:

- Capital Gains Example: If you buy a share of Company A for $10 and its price rises to $20, you can sell it for a $10 profit.

- Dividends Some companies share profits with shareholders. If a company pays a dividend of $0.50 per share and you own 100 shares, you receive $50.

4. Remember: Stocks Carry Risk

Stock prices don’t always go up. They can fall because of:

- Poor company performance

- Economic downturns or interest rate hikes

This means stocks come with higher potential returns but also higher risks.

5. Where Are Stocks Traded?

You usually buy and sell stocks through a broker’s app, but behind the scenes, it all happens on stock exchanges:

- NYSE (New York Stock Exchange)

- Nasdaq

These markets provide a regulated space for trading.

6. Quick Summary

- Stocks = partial ownership of a company

- Companies issue stocks to raise money

- Investors earn through capital gains and dividends

- Stocks offer growth opportunities but also risks

- Stock exchanges provide the marketplace

In short, stocks are like a ticket to ride along with a company’s journey. If the company thrives, so do you. If it struggles, you share that too.