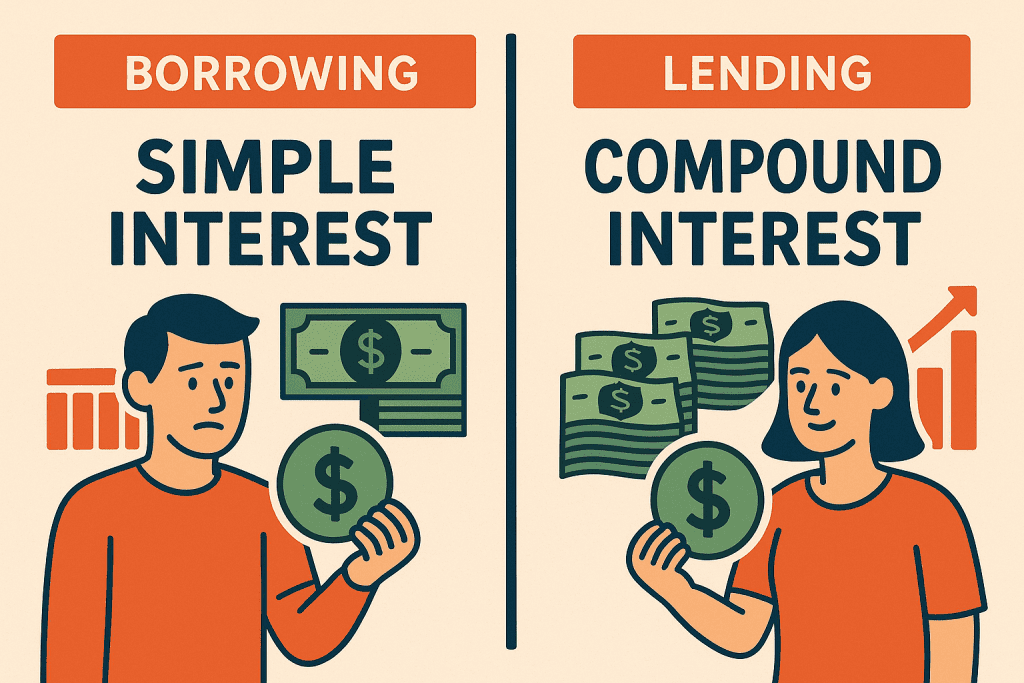

1) Borrower’s Perspective — Keep It Simple

When you’re borrowing money, the simpler the calculation, the better.

- Simple Interest Loans

- Interest is charged only on the original principal.

- Example: Borrow $10,000 at 5% simple interest for 3 years → Total interest = $1,500.

- Predictable, transparent, borrower-friendly.

- Compound Interest Loans

- Interest is charged on both the principal and accumulated unpaid interest.

- Example: Borrow $10,000 at 5% annual compound interest for 3 years → Total interest ≈ $1,576.

- Debt grows faster the longer it lasts.

👉 Borrower’s Strategy: Favor simple interest whenever possible. If stuck with compound interest (credit cards, student loans, mortgages):

- Pay more than the minimum to cut down principal early.

- Avoid unnecessarily long loan terms.

- Consider refinancing if rates fall, but weigh the costs.

2) Lender’s Perspective — Let Compounding Work for You

When you’re lending money or investing, compounding is your greatest ally.

- Simple Interest Returns

- Interest accrues only on the original loan.

- Example: Lend $10,000 at 5% simple interest for 10 years → Total interest = $5,000.

- Compound Interest Returns

- Each year’s interest earns its own interest.

- Example: Lend $10,000 at 5% annual compounding for 10 years → Total interest ≈ $6,289.

- Higher compounding frequency = higher return.

👉 Lender’s Strategy: Choose compound interest whenever possible. That’s why banks:

- Charge borrowers compound interest, but

- Often pay savers lower, less frequent interest.

For individuals: reinvest dividends and interest, start early, and let time multiply returns.

3) The Trade-off — Two Sides of the Same Coin

- Borrowers win with simple interest because debt growth is limited.

- Lenders win with compound interest because returns snowball.

That’s why:

- Credit cards (daily compounding) are a nightmare for borrowers but a gold mine for issuers.

- Savings accounts and bonds (compound interest) reward patient savers and long-term investors.

4) Practical Takeaways

- When Borrowing:

- Seek simple interest loans where possible.

- For compound interest loans, pay down principal aggressively.

- Avoid carrying revolving credit (like credit cards).

- When Lending or Investing:

- Maximize compound returns.

- Reinvest interest/dividends to accelerate compounding.

- The earlier you start, the stronger the snowball effect.

5) 30-Second Summary

- Borrowers should prefer simple interest and minimize compounding exposure.

- Lenders and investors should prefer compound interest to harness exponential growth.

- The same math can be a trap from the borrower’s side or a treasure chest from the lender’s.

- Smart financial strategy is not about changing the formula — it’s about choosing your side wisely.