– Trend Insight by FinancePick

Why the GLP-1 Drug Market Is Exploding in 2025

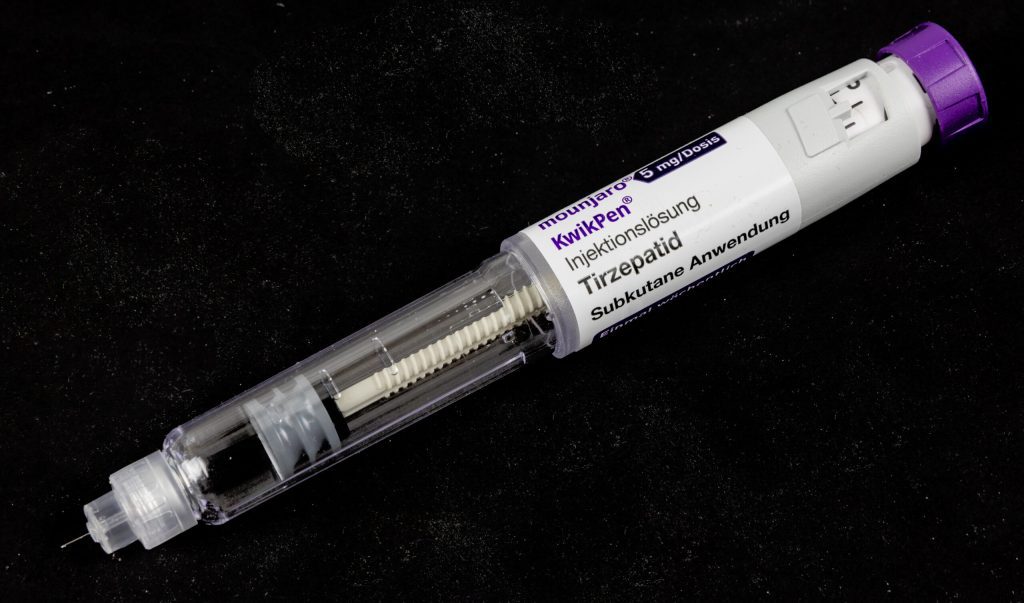

Few themes have captured Wall Street and Main Street alike in 2025 as much as GLP-1 therapies. Originally developed for type 2 diabetes, these drugs—such as Wegovy, Ozempic, Mounjaro, and Zepbound—are now redefining obesity treatment and even showing potential in reducing cardiovascular risks. More than 1 in 10 American adults have already tried a GLP-1 medication, and U.S. healthcare spending on this class has surged dramatically. This makes the space one of the most important battlegrounds in pharmaceuticals today.

In this preview, we compare Eli Lilly, Novo Nordisk, and Amgen—the three companies most closely watched by investors, physicians, and policymakers.

Eli Lilly (LLY) — Growth Leader with Supply Challenges

- Products: Zepbound (obesity), Mounjaro (type 2 diabetes).

- Financials: Q2 2025 revenue jumped 38% YoY to $15.56B, with obesity and diabetes drugs driving the beat. Guidance for the year was raised on stronger-than-expected demand.

- Strengths: Dual-action mechanism (GLP-1 + GIP) shows superior efficacy in both weight reduction and glycemic control. Insurance coverage and patient access are improving, widening the addressable market.

- Weaknesses: Persistent supply bottlenecks. Manufacturing expansion is ongoing but demand continues to outstrip availability. Market closely watching oral formulation trials, which could dramatically expand uptake but also introduce volatility.

- Catalysts: Production capacity updates, expansion of reimbursement programs, and potential new data on oral GLP-1/GIP candidates.

Novo Nordisk (NVO) — The First Mover Defending Its Position

- Products: Wegovy (obesity), Ozempic (diabetes).

- Strengths: Global brand recognition and physician familiarity make NVO the household name in GLP-1 therapy. Importantly, clinical trials suggest Wegovy reduces cardiovascular events—a potential game-changer for payers and regulators considering long-term cost-effectiveness.

- Weaknesses: Growth is still robust but lags behind Lilly’s explosive trajectory. Supply constraints have been partially resolved but production capacity remains capped.

- Catalysts: Upcoming ESC 2025 presentations on cardiovascular outcomes could strengthen payer adoption. Watch for regulatory updates on expanded labeling (e.g., heart failure, stroke prevention).

Amgen (AMGN) — The Challenger with a Monthly Shot

- Pipeline: MariTide (maridebart cafraglutide), currently in Phase 2.

- Strengths: Early data shows up to ~20% weight reduction sustained through 52 weeks, with both diabetic and non-diabetic cohorts seeing benefits. The once-monthly dosing schedule could be a major differentiator, simplifying adherence compared to weekly injections.

- Weaknesses: Still in mid-stage trials; commercialization is years away. Phase 3 execution risk is high, as efficacy and safety must replicate earlier results across larger populations.

- Catalysts: Phase 3 trial initiation details, further safety data, and any partnership/licensing updates. If successful, Amgen could carve out a significant niche in a rapidly expanding market.

Side-by-Side Comparison

| Company | Strengths | Weaknesses / Risks |

|---|---|---|

| Eli Lilly (LLY) | Dual-action drugs (Zepbound, Mounjaro) driving industry-leading growth | Supply bottlenecks persist; pipeline highly sensitive to oral formulations |

| Novo Nordisk (NVO) | Global brand recognition (Wegovy, Ozempic); strong CV outcome data | Slower growth vs. Lilly; production capacity limits remain |

| Amgen (AMGN) | MariTide (monthly dosing candidate) shows ~20% weight reduction, differentiation potential | Still in Phase 2; commercial launch at least 2–3 years away |

Market Outlook for 2025 and Beyond

The GLP-1 boom is unlikely to slow in the near term. Both Lilly and Novo are racing to expand production capacity to match surging demand. Payers and policymakers are grappling with the soaring cost of widespread GLP-1 usage, but cardiovascular outcome data could shift the debate toward prevention benefits. Meanwhile, Amgen represents the “wild card”: if MariTide succeeds, it could transform the competitive landscape by offering a more convenient regimen with comparable or superior efficacy.

For investors, the key variables to monitor include:

- Manufacturing scale-up timelines (Lilly/Novo).

- Insurance coverage expansion and real-world utilization.

- Pipeline differentiation—especially oral GLP-1s and Amgen’s monthly shot.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Please do your own research or consult a financial advisor before making investment decisions.