A FinancePick Deep Dive

The Rise of a Viral Moment

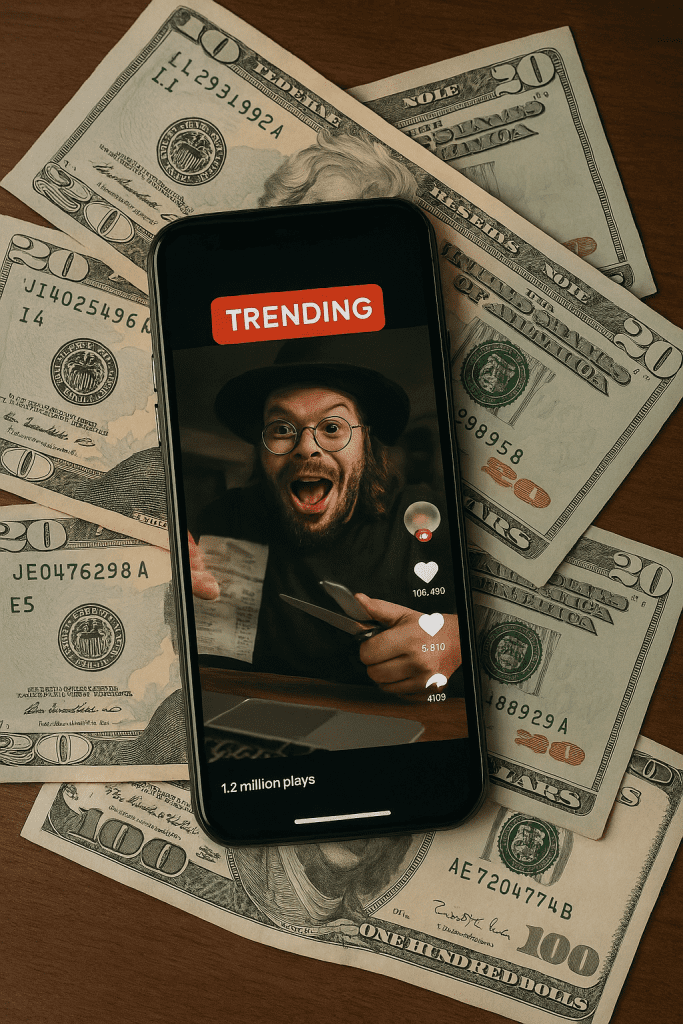

When the name King Cobra JFS spiked on Google Trends, most mainstream observers asked the same question: “Who?” But within hours, the niche online figure became a household search term, catapulted by viral videos and sudden media coverage. The case may appear trivial at first glance—just another flash-in-the-pan internet moment. Yet, in economic terms, it reveals a powerful truth: online virality can generate, distort, and sometimes destroy economic value.

The Attention Economy at Work

In the digital age, attention itself is currency. Platforms monetize clicks, shares, and views; advertisers follow the crowd wherever it moves. For unknown figures like King Cobra JFS, sudden virality translates into YouTube ad revenue, Patreon subscribers, or merchandise sales. But the mechanism isn’t unique to internet personalities—it’s the same engine driving meme stocks like GameStop and AMC.

In both cases, community-driven hype substitutes for traditional valuation. The logic is simple: if enough people watch, talk, and buy, then value—whether cultural or financial—appears to materialize.

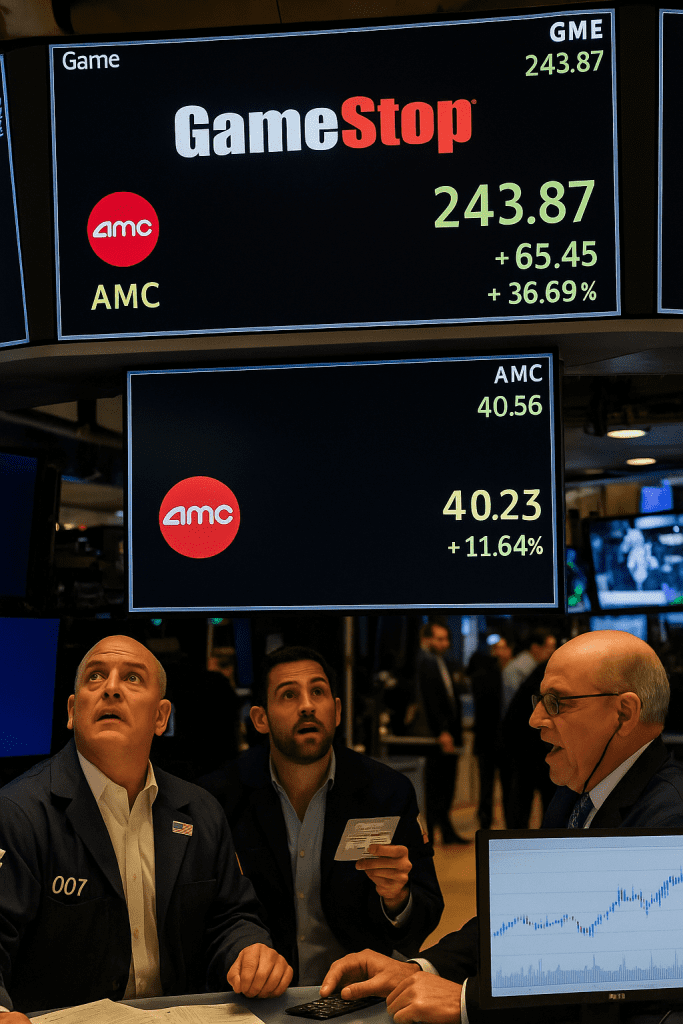

Meme Stocks: The Wall Street Parallel

The viral trajectory of King Cobra JFS mirrors that of meme stocks. When online communities on Reddit’s r/WallStreetBets propelled GameStop’s stock price from under $20 to over $300 in early 2021, they demonstrated the same principle: collective attention can override fundamentals.

- Increased Demand: Retail investors piled in, not because of earnings reports, but because of shared narratives.

- Volatility: Prices swung wildly, just as viral trends spike and collapse within days.

- Secondary Markets: Just as viral creators monetize merchandise, meme stock momentum spilled into options markets, hedge fund short squeezes, and financial headlines.

The parallel suggests that virality itself has become an economic driver, influencing not only internet culture but capital markets.

When Virality Distorts Value

The economics of virality highlight two critical tensions:

- Short-Term Value Creation Viral moments can produce real financial gains—advertising revenue, merchandise sales, stock rallies.

- Fragile Foundations The very speed of attention-driven value makes it unstable. Viral figures can fade as quickly as they appeared, and meme stocks often crash once the collective narrative loses steam.

In both cases, virality inflates perceived value beyond intrinsic fundamentals, creating bubbles that can enrich early participants but punish latecomers.

Broader Economic Lessons

The King Cobra JFS moment is not about one individual; it is a microcosm of the attention economy that now shapes culture and markets alike.

- Investors should recognize the parallels between viral content cycles and speculative trading.

- Companies must understand that brand reputation can be created—or destroyed—within days through viral exposure.

- Policymakers should note that markets increasingly respond not just to fundamentals, but to online narratives amplified by digital communities.

Conclusion – When Culture Becomes Capital

The lesson from King Cobra JFS to GameStop is clear: attention has become a tradable asset.

What begins as a viral clip can ripple into advertising markets, consumer spending, and even stock exchanges. In a world where memes move markets, the boundary between culture and capital is thinner than ever.

And just like a trending search term, economic value in the age of virality is only as strong as the crowd’s attention span.