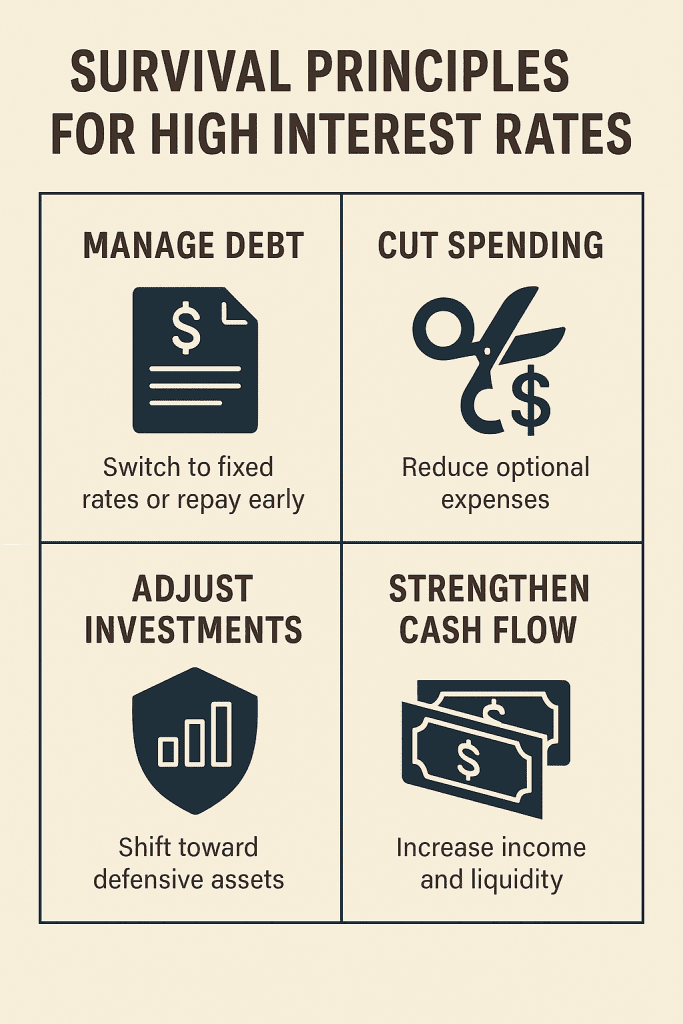

1) Debt Management — “Cutting Interest Is the Best Investment”

- Variable → Fixed Rate Consideration

- Even if today’s fixed rates look high, they protect you if rates climb further.

- If rates are already peaking, keeping variable may work — but timing is crucial.

- Early Repayment (Prepayment)

- Paying down debt at 6–7% interest beats earning 2% in savings.

- Always check prepayment penalties or lost tax benefits before acting.

- Refinancing

- Worth it if the new rate is lower and savings exceed refinancing costs.

- Improved credit score or rising home value may unlock better terms.

2) Spending Strategy — Split Into “Essential, Optional, Postponable”

- Essential: housing, healthcare, education.

- Optional: dining out, vacations, hobbies — cut these first.

- Postponable: big-ticket items like cars or appliances — delay until rates ease.

In a high-rate world, cash flow defense is priority #1. Don’t take on new debt for non-essentials.

3) Investment Strategy — “Shift Toward Defensive Assets”

- Bonds: High rates mean better yields — time to increase allocation.

- Dividend/Defensive Stocks: Consumer staples, utilities, healthcare.

- Cash & Money Market Funds (MMFs): Earn safe yields while keeping liquidity.

- Avoid leverage: Borrowing to invest is especially dangerous in high-rate times.

In high interest rate environments, defense beats offense.

4) Cash Flow Management — “Small Habits Save Big Money”

- Autopay discounts: Many lenders cut rates 0.2–0.3% for autopay.

- Split repayments: Biweekly loan payments lower average balances and reduce interest.

- Extra income streams: A side hustle or freelance income can offset interest burden.

5) High Rates Also Create Opportunities

- Savings & Deposits: Higher yields on low-risk assets.

- Dollar & Foreign Assets: Currency appreciation from rate differentials.

- Real Estate: Higher rates cool demand, creating buyer’s opportunities.

6) Action Checklist

- List your debts: fixed vs variable, maturities, early repayment terms.

- Categorize expenses into essential / optional / postponable.

- Allocate spare cash into bonds, deposits, MMFs.

- Rebalance investments: less leverage, more defensive positions.

- Build liquidity to prepare for opportunities after peak rates.

30-Second Summary

- Borrowers: Cut debt costs with fixed rates, early repayments, or refinancing.

- Households: Defend cash flow by slashing optional spending.

- Investors: Go defensive — bonds, dividend stocks, and cash reserves.

- Opportunities: High-rate environments reward savers and patient buyers.

High interest rates are both risk and opportunity. The key is protecting today’s cash flow while positioning for tomorrow’s openings.