1) Why Are Bonds Interesting? — The Coffee Coupon Analogy

Imagine buying a 10-cup coffee voucher book. Each month you get a free drink (the coupon interest) and when the book expires, you get your deposit (principal) back.

- If the voucher becomes more expensive, your return is lower.

- If the voucher is cheaper, your return is higher.

That’s why bond prices and yields move like a seesaw—when interest rates rise, bond prices fall, and vice versa.

2) Key Terms You Must Know

- Face Value (Par): The principal repaid at maturity, usually set at 100.

- Coupon Rate: The promised annual (or semiannual) interest.

- Maturity: The date when the principal is returned.

- Yield to Maturity (YTM): The effective annual return if held until maturity.

- Credit Rating: A score measuring repayment ability; lower rating means higher required yield.

- Spread: Extra yield demanded compared to a risk-free benchmark (like U.S. Treasuries).

3) How Is a Bond Priced? (Simple but Powerful Math)

Principle: Bond price = Present Value of all future coupons + Present Value of final principal.

Example: 3-year bond, 5% coupon, face value 100.

- At yield 4% → Price ≈ 102.78

- At yield 5% → Price = 100.00

- At yield 6% → Price ≈ 97.33

So, when yields rise, the present value of future cash flows falls—hence, bond prices drop.

4) Duration and Convexity — Sensitivity to Interest Rates

- Duration: Measures how much a bond’s price changes when interest rates move.

- Example: Modified duration ≈ 2.72 → a 1% rise in rates cuts price by ~2.72%.

- Convexity: Adjusts for curvature, making sensitivity estimates more accurate during large rate shifts.

👉 Think of duration as the “speedometer” and convexity as the “steering correction.”

5) Types of Bonds (Collect Them Like Character Cards)

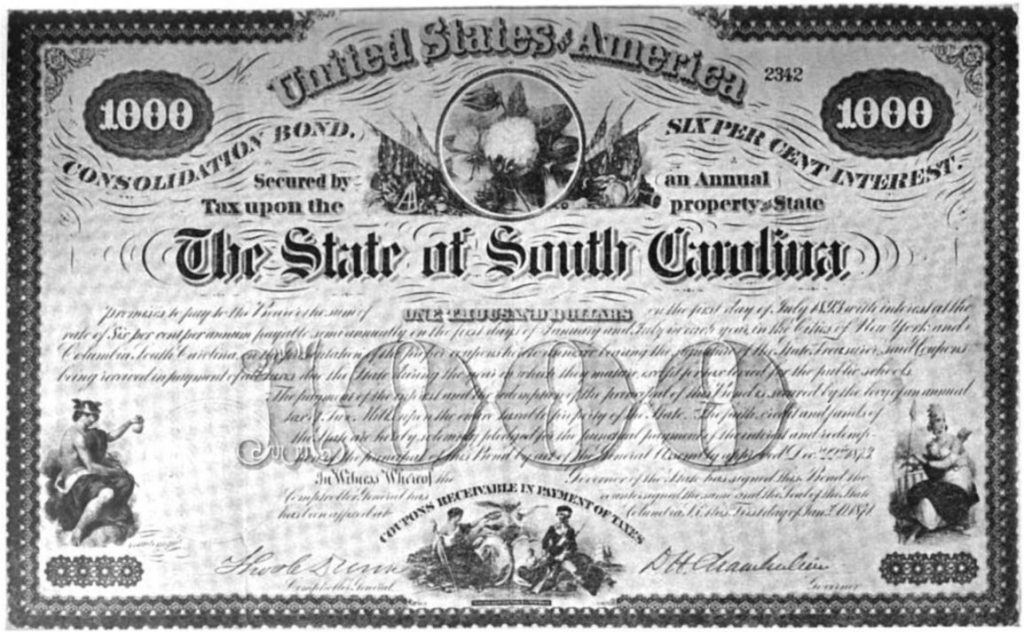

- Government Bonds (Treasuries): Baseline “risk-free” assets.

- Municipal Bonds: Issued by local governments or agencies.

- Corporate Bonds: Issued by companies, classified as investment grade or high yield.

- Convertible Bonds: Can be exchanged into stock.

- Inflation-Linked Bonds (TIPS): Adjusted to protect purchasing power.

- Special Variants: Callable bonds, covered bonds, perpetuals, and more.

6) The Yield Curve — The Market’s Economic Weather Map

Plot yields against maturities and you get the yield curve.

- Normal (upward sloping): Longer maturities = higher yields.

- Flat or Inverted: May signal economic slowdown or changes in monetary policy.

The yield curve is like the bond market’s collective “forecast” for the economy.

7) The 5 Major Risks of Bonds

- Interest Rate Risk: Prices fall when rates rise (greater with long duration).

- Credit Risk: Issuer might default.

- Liquidity Risk: Hard to trade at fair value.

- Reinvestment Risk: Coupons may be reinvested at lower rates.

- Call/Option Risk: Issuer may repay early, altering returns.

8) Reading a Bond Quote

Example: 5% coupon, maturing 2030-06-30, price 98.50 (clean).

- Dirty Price = Clean Price + Accrued Interest.

- Current Yield = Coupon ÷ Price.

- YTM = Full internal rate of return.

- Spread = “Government bond + X basis points (bp).”

9) Bonds in Your Portfolio

- Stability Buffer: Bonds may soften stock volatility.

- Cash Flow Planning: Maturity laddering matches investment with spending needs.

- Macro Positioning: Use inflation-linked bonds or short vs. long duration exposure.

10) Quick Example

Bond A: 3-year, 5% coupon, face 100.

- At yield 5% → Price = 100

- At yield 6% → Price ≈ 97.33

- At yield 4% → Price ≈ 102.78

Rule of thumb: Rates ↑ → Price ↓; Rates ↓ → Price ↑.

11) Common Misconceptions

- “Coupon = my return.” → Wrong! Return depends on the price you paid.

- “No risk if I hold to maturity.” → Defaults, early calls, and reinvestment risks still matter.

- “Government bonds are always safe.” → Credit risk is tiny, but interest rate risk is real—especially for long maturities.

12) Investor’s Checklist

- Goal: Stability, income, or macro bet?

- Duration: How sensitive can you afford to be to rate changes?

- Credit Quality: Yield trade-off vs. default risk.

- Liquidity: Can you exit when you want?

- Taxes & Fees: Country-specific considerations.

13) 30-Second Summary

- Bonds = promises of future cash flow.

- Prices move opposite to yields.

- Duration and convexity measure rate sensitivity.

- Bonds provide income, stability, and economic signals.

Far from being boring, bonds are the mathematics of promises—a tool to design the future you want with the cash flows you need.